Need some health making plan decisions? Click on the Ask ALEX image below to be directed to the benefit decision making conversation page!

2023 Benefits

Medical Benefits

Eligibility

Non-Union: All employees who work a minimum of 24 scheduled hours are eligible for coverage on the 1st day of the month following 30 days of eligible service.

Union: All employees who work a minimum of 24 scheduled hours are eligible for coverage on the 1st day of the month following 60 days of eligible service.

Summary of Benefits and Coverages

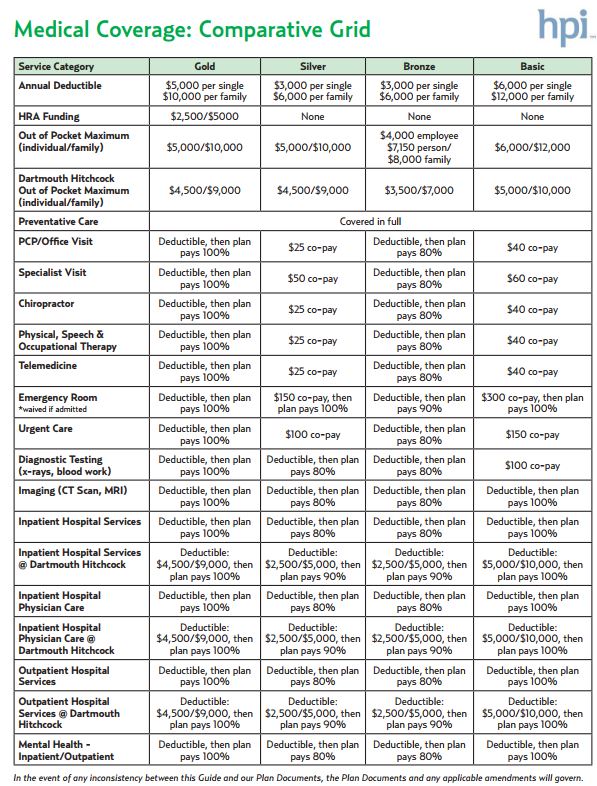

Brattleboro Retreat offers four medical plans for employees to choose from – Gold, Silver, Bronze or Basic- with varying deductibles, copays, and coinsurance to fit the unique benefit needs of employees.

The chart below provides a high level overview of the medical plan design and features.

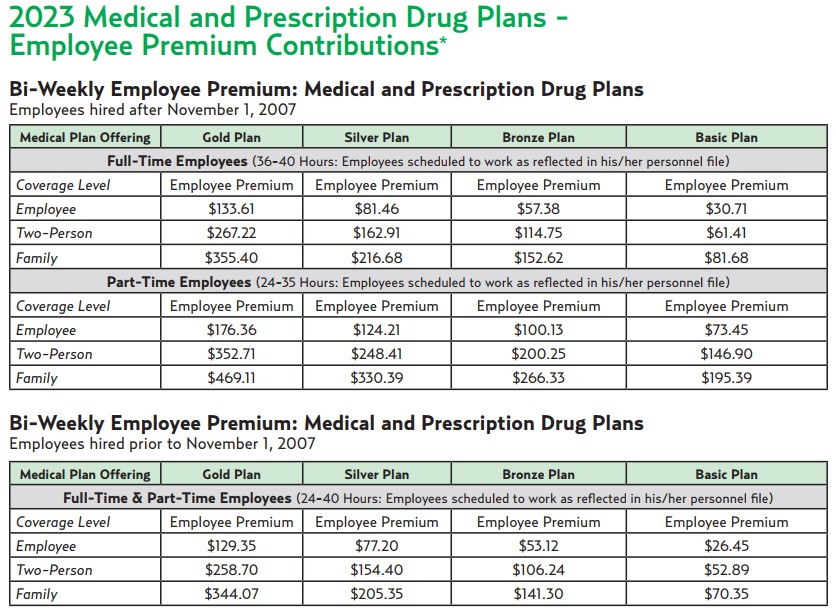

Contributions & Rates

Carrier Contact Information

Health Plans Inc: Medical Insurance

Customer Service: 888-335-9400

Website: http://www.healthplansinc.com

Please click here for the HPI Provider Directory

Plan Documents

Additional Information

Transparency in Coverage – Machine Readable Files

By clicking this link (HPI Machine Readable Files), you will be led to the machine readable files that are made available in response to the federal Transparency in Coverage Rule and includes negotiated service rates and out-of-network allowed amounts between health plans and healthcare providers. The machine-readable files are formatted to allow researchers, regulators, and application developers to more easily access and analyze data.

Telehealth Benefits

Summary of Benefits and Coverages

The Brattleboro Retreat’s affiliation with Harvard Pilgrim/Doctor on Demand provides you with the convenience of attending physician visits from your mobile phone, tablet, or computer.

In addition to being fast and easy, you are only required to pay a copay or coinsurance that is the same as your PCP/Office Visit copay and may be significantly less than an emergency room or urgent care visit.

Some of the top medical issues that are treated include:

- Children’s health

- Coughs/Colds

- Sore/Strep Throat

- Flu

- Sinus and allergies

How it works:

- Download the app on your mobile device or access doctorondemand.com

- Create an account and enter your insurance and pre-consult information.

- Pay your copay/cost share via the app or website.

- Consult with a Doctor on Demand board certified provider.

- Receive an email follow up after the visit to share with your PCP or request that t be sent directly to your PCP.

Help Center Contact Information

Prescription Drug Plan

Prescription Drug Plan Overview

Employees must enroll in a Brattleboro Retreat medical plan to participate in the prescription drug coverage. Optum Rx manages the prescription drug program.

The cost of prescription drugs continues to increase year-after-year, particularly the cost of specialty drugs. Employees may save money by purchasing a 90-day supply of approved – mail order drugs through the Dartmouth Hitchcock Pharmacy, Lebanon. Employees may find additional savings by utilizing CanaRx, an international mail order drug program for brand name prescriptions. Furthermore, employees may find additional savings by utilizing prescription coupons made available at various websites such as GoodRx.com and Walmart.com.

CanaRx Program

CanaRx is an international mail order drug program for brand name prescriptions. Eligible employees and their dependents enrolled in the Gold, Silver, Bronze or Basic medical plans have the option of ordering brand name maintenance medications at $0 co-pay through the CanaRx program. This is a voluntary program and does not replace the Brattleboro Retreat’s current prescription benefit plan. Advantages to the plan include $0 copays for all prescriptions offered through the program; no shipping and handling costs; easy enrollment process.

Visit the Brattleboro Retreat’s CanaRx website by clicking here

Or call 866-893-6337 for more information on how to enroll.

Important Contact Information

RxBenefits: Pharmacy Program

Customer Service: 800-334-8134

email: RxHelp@rxbenefits.com

Dartmouth Hitchcock: Mail Order Pharmacy

Customer Service: 603-653-3785

Email: dh.pharmacy@hitchcock.org

Dartmouth Hitchcock: Specialty Pharmacy

Customer Service: 603-353-3737

Email: specialty.pharmacy@hitchcock.org

Important Information

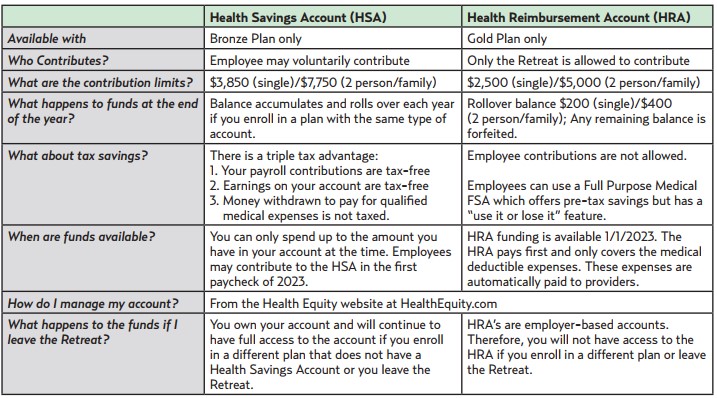

Health Reimbursement Accounts, Health Savings Accounts & Flexible Spending Accounts

Health Savings Accounts (HSA)

A HSA is a tax-advantaged account that allows employees to save pre-tax dollars to pay for qualified medical expenses. The HSA is administered by Health Equity, Inc. For a list of eligible expenses please visit healthequity.com

To be eligible to enroll in a HSA, you must meet the following requirements:

- You are enrolled in the Bronze Plan.

- You aren’t enrolled in Medicare.

- You can’t be claimed as a dependent on someone else’s tax return.

- You aren’t insured under any other medical plan that is not a HDHP.

- You haven’t received VA benefits (Medical or Rx) during the past 3 months.

Health Savings Account (HSA)

- Employees are eligible to participate in a HSA if they are enrolled in the Bronze Plan.

- The account is 100% employee funded.

- Employees who wish to contribute to a HSA must activate their account through Health Equity by registering online at myhealthequity.com

- Employees will also have to name a beneficiary for their account and call Health Equity, Inc at 866-346-5800 to activate their HSA debit card.

- 2023 Contribution Limits:

- Single – $3,850

- Family – $7,750

- Catch-up contribution (age 55+) – $1,000

Health Reimbursement Accounts (HRA)

The HRA allows for reimbursement for incurred Gold Plan deductible expenses. The funding amounts provided to the HRA by the Brattleboro Retreat will be made available on the first day of the Plan Year, January 1, 2023. Only expenses incurred in the calendar plan year (January 1 through December 31) will be eligible for reimbursement from that year’s HRA.

The Brattleboro Retreat will roll over up to $200 unused dollars to the next year for any employee enrolled in the Gold Plan individual coverage, and up to $400 unused dollars for anyone enrolled in double of family Gold Plan coverage. You must enroll in the Gold Plan in the following calendar year to receive roll over funds; if you move to a different plan choice the HRA will not be available.

Health Reimbursement Account (HRA)

- Employees are eligible to participate in a HRA if they are enrolled in the Gold Plan.

- The account is 100% funded by the Brattleboro Retreat.

- The HRA pays the first $2,500 (Single) and $5,000 (Family) of qualified deductible expenses.

Flexible Spending Accounts

Flexible Spending Medical Account (FSA)

The Full Purpose- Medical FSA is a pre-tax savings account available to employees enrolled in the Gold, Silver or Basic Plan or to those who waive medical benefits. The FSA can be used to pay for eligible health care, dental, or vision care expenses that are not covered by insurance for you and your eligible dependents.

- Employees may contribute up to a maximum of $3,050 in 2023 to a health FSA.

- Health Equity administers the Flexible Spending Accounts and after signing up, you will receive a Flex debit card which can be used at the time of purchase for eligible health care expenses.

- A full listing of IRS-approved expenses can be found at healthequity.com

- This plan includes a rollover provision that allows employees who elect the FSA to rollover up to $610 of unused funds into the next plan year. And if you have funds available, you will be automatically enrolled in the FSA for the next year. (Note: the roll-over does not count towards the IRS maximum allowed in the FSA contribution)

- If you want to contribute in addition to your roll-over, you must make that additional election.

- The deadline for submitting 2022 medical and dependent care claims for reimbursement is March 31, 2023. You may reimburse yourself for expenses incurred between January 1 and December 31, 2022 as long as they were incurred when you were in an active participant in the plan.

Dependent Care -FSA (DC-FSA)

The DC-FSA is a pre-tax savings account that may be used to pay for eligible elder and/or child care expenses.

- Employee may contribute up to a maximum of $5,000 (if single or married filing jointly) or $2,500 (if married filing separately).

- In order to qualify for reimbursement, expenses must be incurred for the care of “eligible dependents” who the IRS defines as:

- A child under the age of 13, or a child of any age who is physically or mentally incapable of self-care.

- Any other dependent who is physically or mentally incapable of self-care and who meets specific criteria.

- A full listing of IRS-approved expenses can be found under the IRS Publication 503, titled Child and Dependent Care Expenses, which is available by calling the IRS at 800-829-1040 or at IRS.gov

Carrier Contact Information

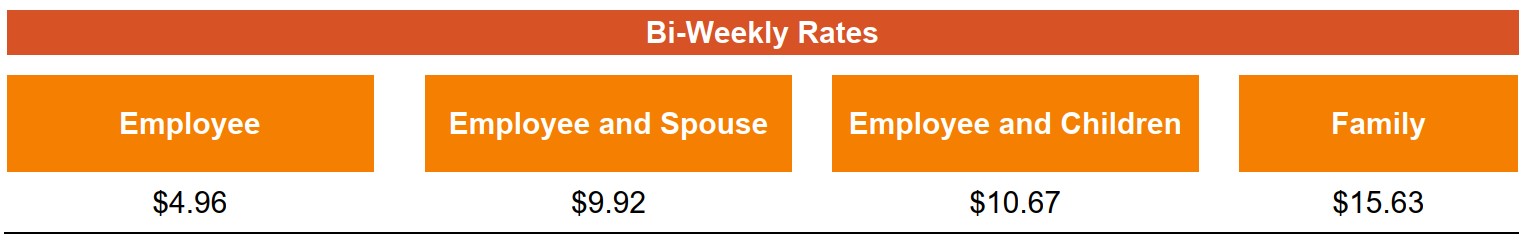

Contributions

HRA: 100% funded by the Brattleboro Retreat.

HSA, FSA & DC-FSA: are all 100% employee funded.

Forms and Plan Documents

Health Savings Account (HSA)

Health Reimbursement Account (HRA)

Flexible Spending Account (FSA) & Dependent Care Account (DCA)

Additional Information

Dental Benefits

Eligibility

Non-Union: All employees who work a minimum of 24 scheduled hours are eligible for coverage on the 1st day of the month following 30 days of eligible service.

Union: All employees who work a minimum of 24 scheduled hours are eligible for coverage on the 1st day of the month following 60 days of eligible service.

Summary of Benefits and Coverages

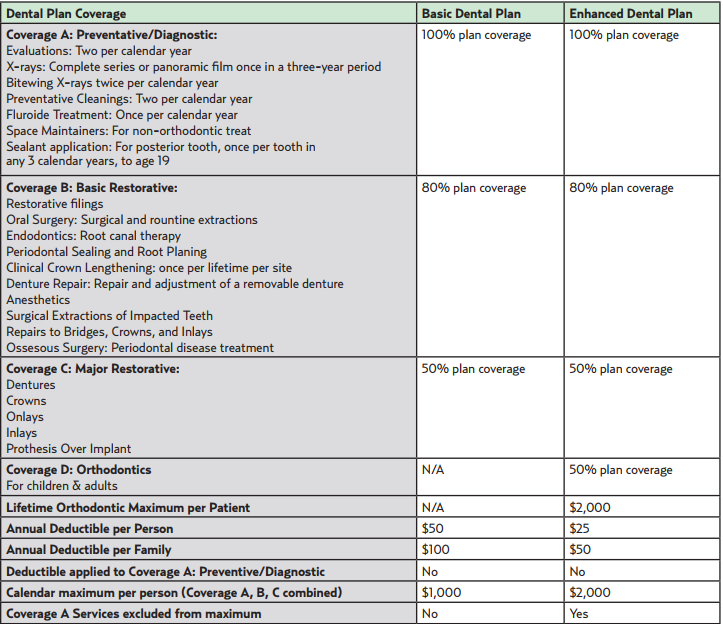

The Brattleboro Retreat offers employees two dental plans options through Northeast Delta Dental.

The chart below provides a high level overview of the dental plan design and features.

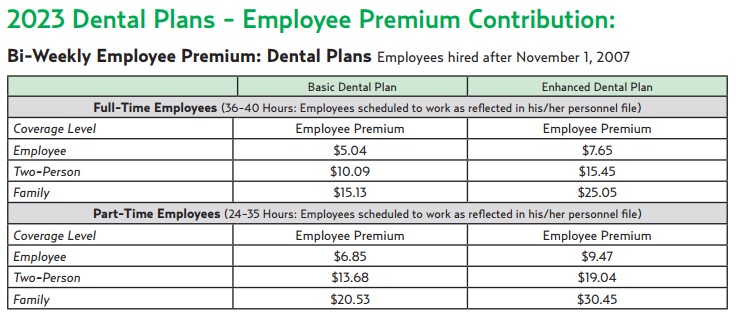

Contributions & Rates

Carrier Contact Information

Northeast Delta Dental: Dental Insurance

Customer Service: 800-832-5700

Website: www.nedelta.com

Please click here for the Northeast Delta Dental Provider Directory

Plan Documents

Helpful Videos from Delta Dental

Vision & Hearing Benefits from Delta Dental

Additional Information

Vision Benefits

Eligibility

Non-Union: All employees who work a minimum of 24 scheduled hours are eligible for coverage on the 1st day of the month following 30 days of eligible service.

Union: All employees who work a minimum of 24 scheduled hours are eligible for coverage on the 1st day of the month following 60 days of eligible service.

Summary of Benefits and Coverages

Brattleboro Retreat and VSP provides you with an affordable vision plan. Get the most of your benefits and greater savings with a VSP network doctor. Your coverage with out-of-network providers will be less or you’ll receive a lower level of benefits. Visit vsp.com for plan details and to search VSP providers.

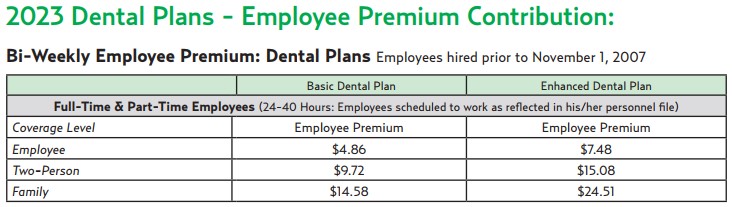

The chart below provides a high level overview of the vision plan design and features.

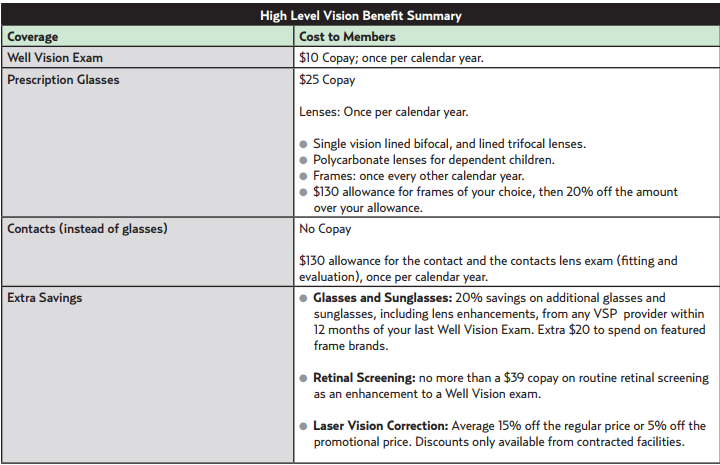

Contributions & Rates

Carrier Contact Information

VSP: Vision Insurance

Customer Service: 800-877-7195

Website: www.vsp.com

Click here for the VSP Provider Directory

Plan Documents

Group & Voluntary Life Benefits

Eligibility

All employees who work a minimum of 24 scheduled hours are eligible for coverage on the first day of the month coincident with or following 60 days of continuous employment.

Summary of Benefits and Coverages

The Brattleboro Retreat provides basic life insurance that covers all benefit-eligible employees following their initial eligibility waiting period with the core benefits of life insurance and accidental death & dismemberment insurance. In addition to these core benefits, employees can supplement their plans by purchasing voluntary life insurance to cover themselves and their families. Please note that if an employee elects Voluntary Life insurance after they are initially eligible, Evidence of Insurability (EOI) will be required and the coverage will have to be approved by the insurance company.

Below is an outline of the coverages available under each plan.

Basic Term Life & AD&D Insurance:

- 100% funded by Brattleboro Retreat

- 1x salary to maximum of $350,000

- Benefits reduce to 65% when you reach age 65 and to 50% when you reach age 70.

Voluntary Employee Term Life & AD&D Insurance:

- 100% employee funded

- Benefit eligible employees may enroll during the initial eligibility waiting period and during open enrollment each year.

- Employees may elect coverage on themselves in $10,000 increments, to a maximum of $500,000 (to a maximum of 7 times annual salary). Voluntary Term AD&D coverage may be chosen in the same amounts and are subject to the same maximums.

- Benefits reduce to 65% when you reach age 65 and to 50% when you reach age 70.

- Employees may elect coverage on their children in $2,000 increments, up to $10,000, for the same cost no matter the number of children they have. Children are covered up to age 19, or up to age 26 as long as they remain a full-time student.

- In order to purchase Voluntary Term Life coverage for your spouse and/or child, you must purchase coverage for yourself.

- Employees may elect up to $150,000 in voluntary coverage for themselves (or up to $30,000 for their dependent spouse) within the first 31 days of employment without having to complete a medical history statement (Evidence of Insurability (EOI) Form). If applying outside the first 31 days of employment, or for coverage in excess of the guarantee issue amounts, a medical history statement is required, and approval is subject to medical underwriting.

Carrier Contact Information

![]()

Customer Service: 800-351-7500

Website: www.reliancestandard.com

Contributions

Group Life is 100% paid for by The Brattleboro Retreat.

Voluntary Life is 100% paid for by the employee. Premium costs are based on the amount of coverage approved and the age of the participant.

Forms & Plan Documents

Long-Term & Short-Term Disability

Eligibility

All employees who work a minimum of 24 scheduled hours are eligible for coverage on the first day of the month coincident with or following 4 months of continuous employment.

Summary of Benefits and Coverages

Long-Term Disability Insurance:

- 100% funded by The Brattleboro Retreat.

- Covers benefit eligible employees following their initial eligibility waiting period.

- Benefit is 60% of total monthly earnings to a maximum of $9,000 per month.

- Payment of benefits begin after 90 days from the start of a qualified disability.

Short-Term Disability Insurance:

- 100% funded by The Brattleboro Retreat.

- Covers benefit-eligible employees following their initial eligibility period.

- Benefit begins on the 8th day after the occurrence of a qualified disability.

- Benefit is 60% of total weekly earnings to a maximum of $2,000 per week.

- Partial benefits are based on the percent of lost wages.

Carrier Contact Information

![]()

Customer Service: (800) 351-7500

To File a Claim: https://www.rslclaims.com/ or (855) 775-2524

Website: www.reliancestandard.com

Both LTD and STD Insurance are 100% covered by the Brattleboro Retreat.

Forms & Plan Documents

Accident, Critical Illness & Hospital Indemnity Insurance

Eligibility

All employees who work a minimum of 24 scheduled hours are eligible for coverage during the annual open enrollment period.

Voluntary Accident Insurance:

100% Employee Paid

Accident Insurance is designed to help employees meet the out-of-pocket expenses and extra bills that can follow a covered accidental injury, whether minor or catastrophic. Lump sum benefits are paid directly to the covered employee if they sustain a covered injury. That benefit payment can be used however you’d like to spend it.

Examples of lump sum benefits payable include:

- $400 for ambulance (ground)

- $225 for an emergency room visit

- $75 for an x-ray

Coverage can be elected for an employee, spouse and/or child. Benefits are paid on a tax-free basis; Employee premiums are deducted on a post-tax basis.

Voluntary Critical Illness Insurance:

100% Employee Paid

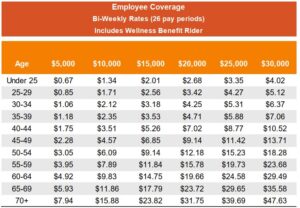

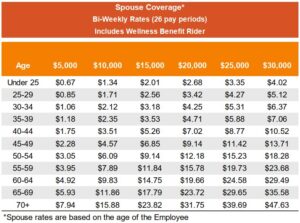

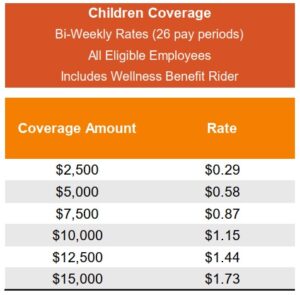

Critical Illness Insurance is designed to help employees offset the financial effects of a catastrophic illness with a lump sum benefit if an insured is diagnosed with a covered critical illness. Coverage is available for employees, spouses, and children. Coverage levels can be elected from $5,000 – $30,000 (in $5,000 increments) for employees and spouses. Coverage for a dependent spouse cannot exceed 100% of the employee amount elected. Coverage for children can be elected from $2,500 – $15,000 (in $2,500 increments) and cannot exceed 50% of the employee amount elected.

Benefits are paid on a tax-free basis; Employee premiums are deducted on a post-tax basis. Rates are based on employee’s age at the date of issue. Spouse rates are based on the employee’s age at issue.

Voluntary Hospital Indemnity Insurance:

100% Employee Paid

With Hospital Indemnity Insurance, you will receive a fixed daily benefit if you have a covered stay in a hospital, that occurs on or after your coverage effective date. Benefits depend on the type of facility and number of days in confinement.

Here is how it works:

- When you are admitted to a covered medical facility, you become eligible for an admission benefit for the first day of confinement with a total benefit amount of $1,000. This benefit is payable once per confinement, up to a maximum of 8 admissions per calendar year.

- Beginning on day two of your confinement, for each day you have a stay in a covered facility, you will be eligible for a fixed daily benefit payment of $100. The benefit amount and maximum number of days per confinement varies by type of facility.

For more information, please review the benefit summaries below.

Additional Plan Documents

Carrier Contact Information

Customer Service: 877-236-7564

Website: https://claimscenter.voya.com/static/claimscenter

Plan Rates

Accident Rates:

Hospital Indemnity Rates:

Employee Critical Illness Rates:

Spouse Critical Illness Rates:

Child Critical Illness Rates:

VOYA Wellness Benefit

Did you know? If you are enrolled in Accident and/or Critical Illness Insurance, you are eligible to receive a $50 wellness benefit to use however you want!

Complete an eligible health screening test and VOYA will send you $50!

- Employees receive an annual benefit of $50

- Spouses receive an annual benefit of $50

- Children receive 100% of your benefit amount per child, with an annual maximum waived for all children.

Please see the flyer below for details on how to file a Wellness Benefit claim

403 (b) Retirement Plan/ROTH IRA

Eligibility

Employees can register and activate a 403(b)/ROTH account after their first payroll is processed by logging onto Lincoln Financials’ website (lgf.com). Employees are eligible for matching employer contributions after one year of employment and must work 1,000 hours of service during the Computation Period (12 month period immediately following date of hire or in any subsequent Plan Year).

Plan Details

Brattleboro Retreat is pleased to offer an employer sponsored 403(b) retirement plan with an employer matching contribution for eligible employees.

- Employees may contribute on a pre-tax or ROTH, after-tax, basis up to the yearly maximum established by the IRS.

- An employee becomes eligible for the employer match after one year of employment (with at least 1,000 hours of service each plan year). The employer match is $0.50 for every dollar the employee defers up to a maximum match of six (6%) percent of gross pay.

- Each year the Brattleboro Retreat may elect to make an employer discretionary contribution to the retirement plan based on an annual review of the hospital’s financial performance.

Carrier Contact Information

Lincoln Financial: 403(b) Retirement Plan

Customer Service: 800-234-3500

Website: www.lfg.com

Plan Documents

SmartConnect - Medicare Resource

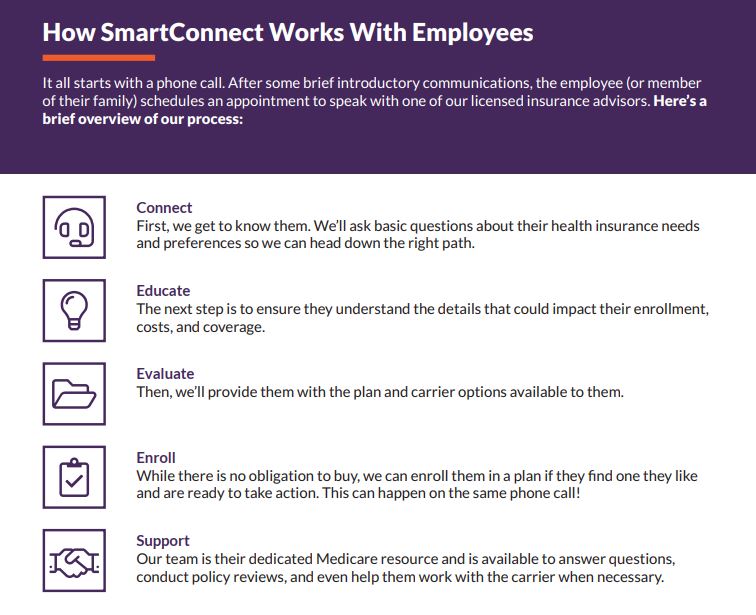

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether you plan to continue working or are transitioning to retirement, SmartConnect tailors solutions designed around your needs. Agents will provide an unfiltered view of the entire range of options and prices available.

SmartConnect Contact Information

For more information or to get started, please click on the following link https://gps.smartmatch.com/therichardsgroup

Additional Information

Employee Assistance Program

Eligibility

All employees are immediately eligible to participate in the Employee Assistance Program (EAP) offered by the Brattleboro Retreat.

Program Details

Brattleboro Retreat’s Employee Assistance Program is a free, confidential, and voluntary program for all employees and their adult household members. It is designed to assist you and/or your household members with a wide range of issues in your personal and work lives. Through KGA you have free access to confidential counseling, expert consultations and referrals to resources including child care, elder care, legal, financial, nutrition, career, and daily living.

More information about the program can be found at www.my.kgalifeservices.com (Company Code: Retreat), or by calling 800-648-9557 open 24 hours a day, 7 days a week.

EAP Contact Information

KGA: Employee Assistance Program

Phone#: 800-648-9557

Website: www.my.kgalifeservices.com

Additional Information

Tuition Benefit & Additional Benefits

Tuition Benefit

Continuing Education

Continuing education dollars are available to assist employees in maintaining and upgrading their job-related skills by attending education programs, seminars, conferences and related programs.

Tuition Assistance Program

Brattleboro Retreat encourages employees to be proactive in their own career development by engaging in formal education activities to further develop their current job skills and to prepare them for future career development in the behavioral health field. Eligible employees may request tuition reimbursement for career options that support the overall strategic plan of the organization and which apply to current/future work requirements.

Employees are eligible for pro-rated funds on the January 1st following their one year anniversary of employment at the Brattleboro Retreat. The maximum calendar year benefit is based upon the cumulative hours worked in the previous year.

Maximum Benefit:

- After one year: $1,000

- After two years: $1,500

- After three years: $2,000

Enhanced Tuition Assistance Program

A program to provide assistance to eligible employees who are interested in pursuing a nursing degree as either an Associates, Bachelors, or a Masters. This benefit is available to a limited number of eligible employees and must be applied for.

529 College Savings Plan

Brattleboro Retreat is pleased to offer a 529 College Savings Plan for employees to be able to save for their child(ren)’s college expenses. Employees may sign-up to contribute to this plan as early as their date of hire. The plan offers tax advantages along with a multi-managed investment platform. All links, enrollment forms and documents are available on iConnect -Departments-Human Resources Department as well as below.

Additional Benefits Provided By the Brattleboro Retreat

Earned Time Off (ETO)

Brattleboro Retreat provides employees time off with pay for vacation, holidays, personal days, and sick days through the earned time benefit. Accrual is based on actual hours paid up to a maximum of 40 hours per week and on the position and length of service of each employee. For more information, please visit the Earned Time Policy on iConnect under Policies and Procedures.

Wellness Program

Our Wellness Program is designed to promote a healthy lifestyle among employees through various program offerings such as: on-site exercise facilities, health fairs, health screenings, seminars and wellness topics.

Contact Information

Brattleboro Retreat Human Resources

For further information, please reach out to the Brattleboro Retreat Human Resources Team:

Phone: 1 (802) 258-6966

529 College Savings Plan: American Funds

Phone: 800-421-4225

Website: americanfunds.com

Account #: 10457446

GradFin – Student Loan Assistance

The Brattleboro Retreat Student Loan Assistance program is designed to help employees pay back student loan debt and improve their financial well-being. Utilizing Brattleboro Retreat’s relationship with our broker, The Richard’s Group, consultation services provided through GradFin are provided FREE OF CHARGE.

GradFin will:

- Provide one-on-one education with an expert to review your current loan status and discuss payoff options

- Offer a competitive interest rate reduction when you refinance your loans

- Provide up to a $300 bonus to you when you refinance your loans with GradFin

- Offer the lowest interest rates in the industry through their lending platform

For more information or to schedule a one-on-one consultation, visit:

https://gradfin.com/platform/trg/

Or call 610.639.7840