2026 Benefits

Wellness Benefits

Eligibility

All employees enrolled in the medical plan and their spouses

Overview

Your health matters. In 2026, we’re continuing our wellness partnership with HealthCheck360 to help you better understand your health and take simple steps toward feeling your best. When you take part, you can unlock valuable savings on your medical premiums for 2027.

What You Can Earn

- Estimated 2027 Premium Discount:

• $15 per pay period (individual)

• $30 per pay period (family)

These are based on the 2026 discount and are subject to change for 2027.

Who Can Earn the Discount

- Employees covered under the health plan

- Spouses covered under the health plan

If your spouse is covered under our health plan, both of you must complete all requirements to unlock the incentive.

2026 Program Requirements

To unlock the 2027 premium discount, complete all items below by August 28th, 2026:

- Biometric Screening

- Complete onsite or with your primary care provider

- On-site option: February 26, 2026

- Health Risk Assessment

- Short online survey

- Review-of-Findings Health Coaching Call

- 1-on-1 review of your screening results & next steps

- Earn 360 Reward Points

- Earn points by completing healthy activities, coaching, and challenges

How to Get Started

- Download the myHC360+ app

- Use company code: BBORO

- Your unique identifier will be the last 4 digits of your SSN

Carrier Contact Information

HealthCheck360: Wellness Platform

Customer Service: 866-511-0360 x5099

Website: https://www.healthcheck360.com/knowledge

Blog: HealthCheck360 Blog

Additional Information

Medical Benefits

Eligibility

All employees who work a minimum of 24 scheduled hours are eligible for coverage on the 1st day of the month following 30 days of eligible service.

Medical Plan Designs

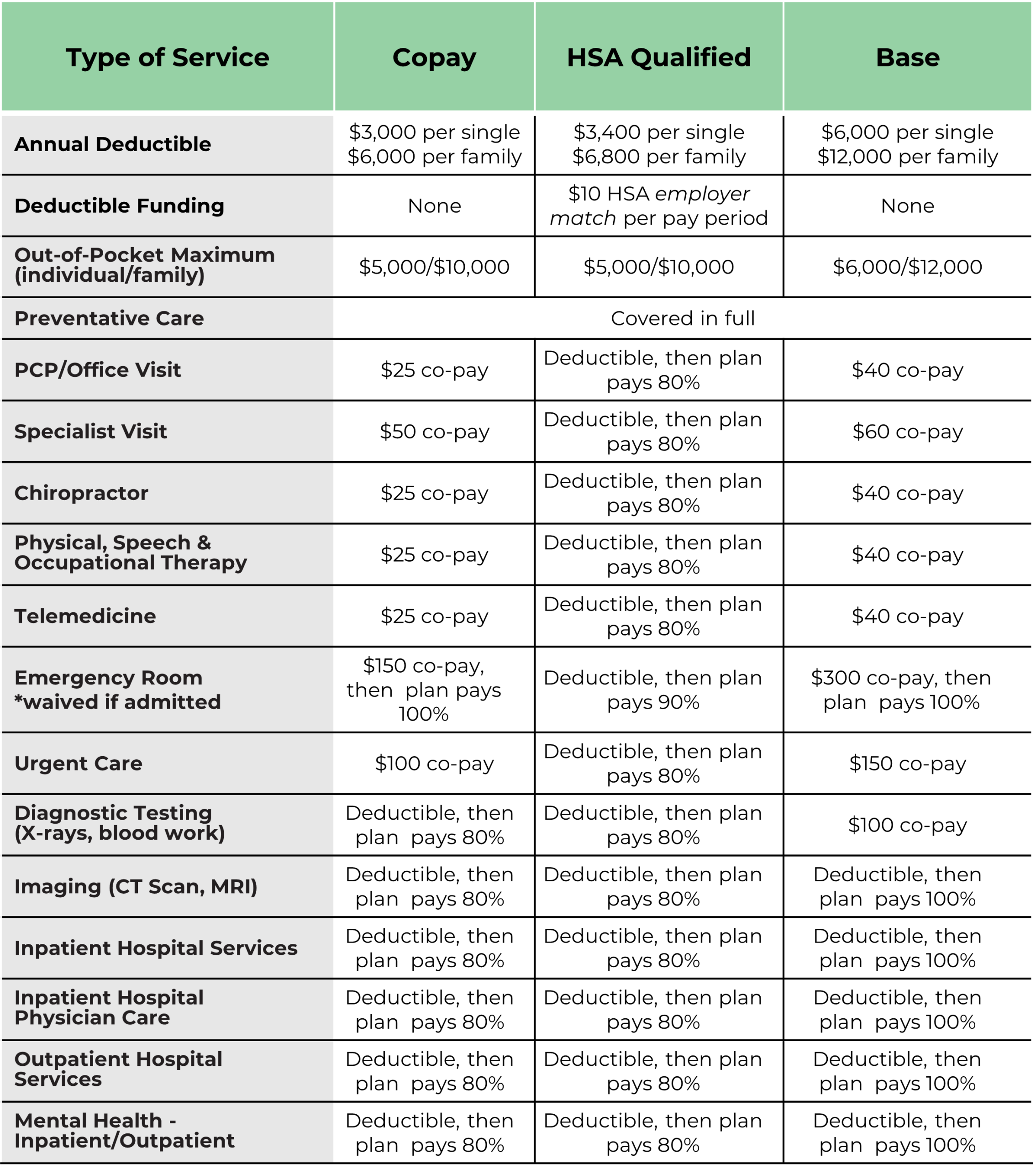

Brattleboro Retreat offers three medical plans for employees to choose from – Copay, HSA Qualified, or Base – with varying deductibles, copays, and coinsurance to fit the unique benefit needs of employees.

The chart below provides a high-level overview of the medical plan design and features.

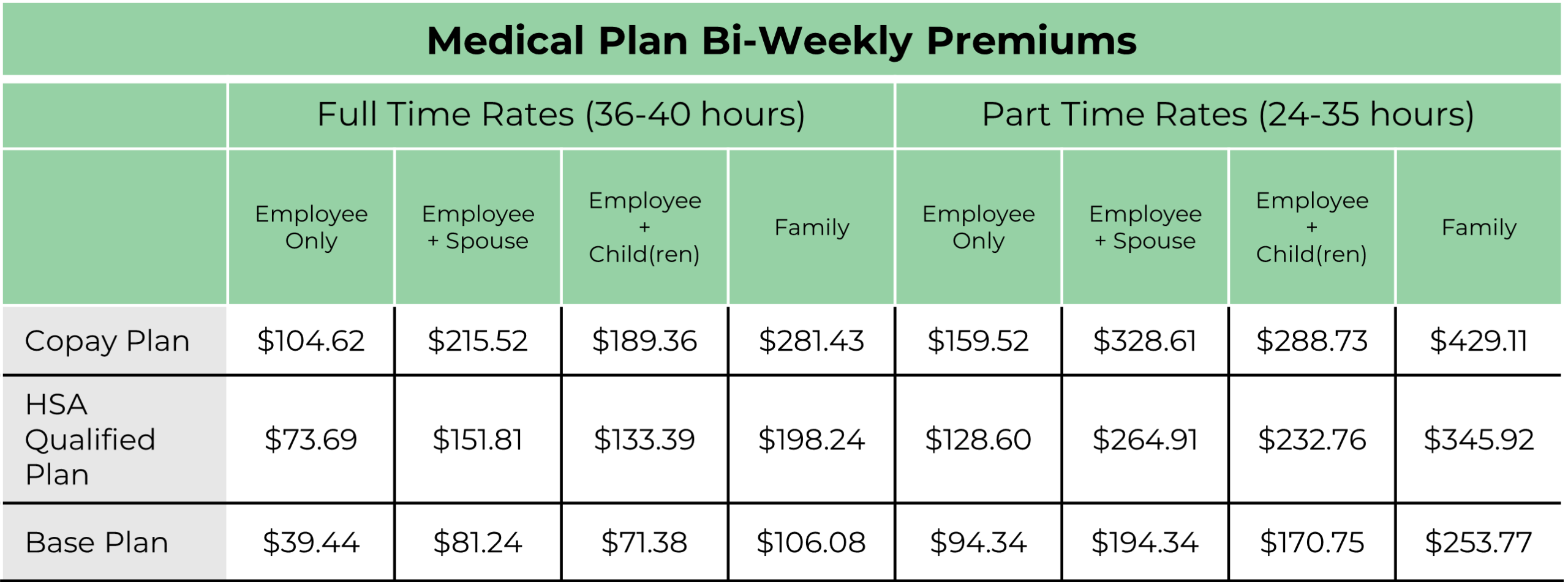

Contributions & Rates

Carrier Contact Information

Health Plans Inc: Medical Insurance

Customer Service: 800-532-7575

Website: https://hpitpa.com/

Please click here for the HPI Provider Directory

Plan Documents

Additional Information

Transparency in Coverage – Machine Readable Files

By clicking this link (HPI Machine Readable Files), you will be led to the machine readable files that are made available in response to the federal Transparency in Coverage Rule and includes negotiated service rates and out-of-network allowed amounts between health plans and healthcare providers. The machine-readable files are formatted to allow researchers, regulators, and application developers to more easily access and analyze data.

Telehealth Benefits

Summary of Benefits and Coverages

The Brattleboro Retreat’s affiliation with Doctor on Demand provides you with the convenience of attending physician visits from your mobile phone, tablet, or computer.

In addition to being fast and easy, you are only required to pay a copay or coinsurance that is the same as your PCP/Office Visit copay and may be significantly less than an emergency room or urgent care visit.

Some of the top medical issues that are treated include:

- Children’s health

- Coughs/Colds

- Sore/Strep Throat

- Flu

- Sinus and allergies

How it works:

- Download the app on your mobile device or access doctorondemand.com

- Create an account and enter your insurance and pre-consult information.

- Pay your copay/cost share via the app or website.

- Consult with a Doctor on Demand board certified provider.

- Receive an email follow up after the visit to share with your PCP or request that t be sent directly to your PCP.

Help Center Contact Information

Prescription Drug Plan

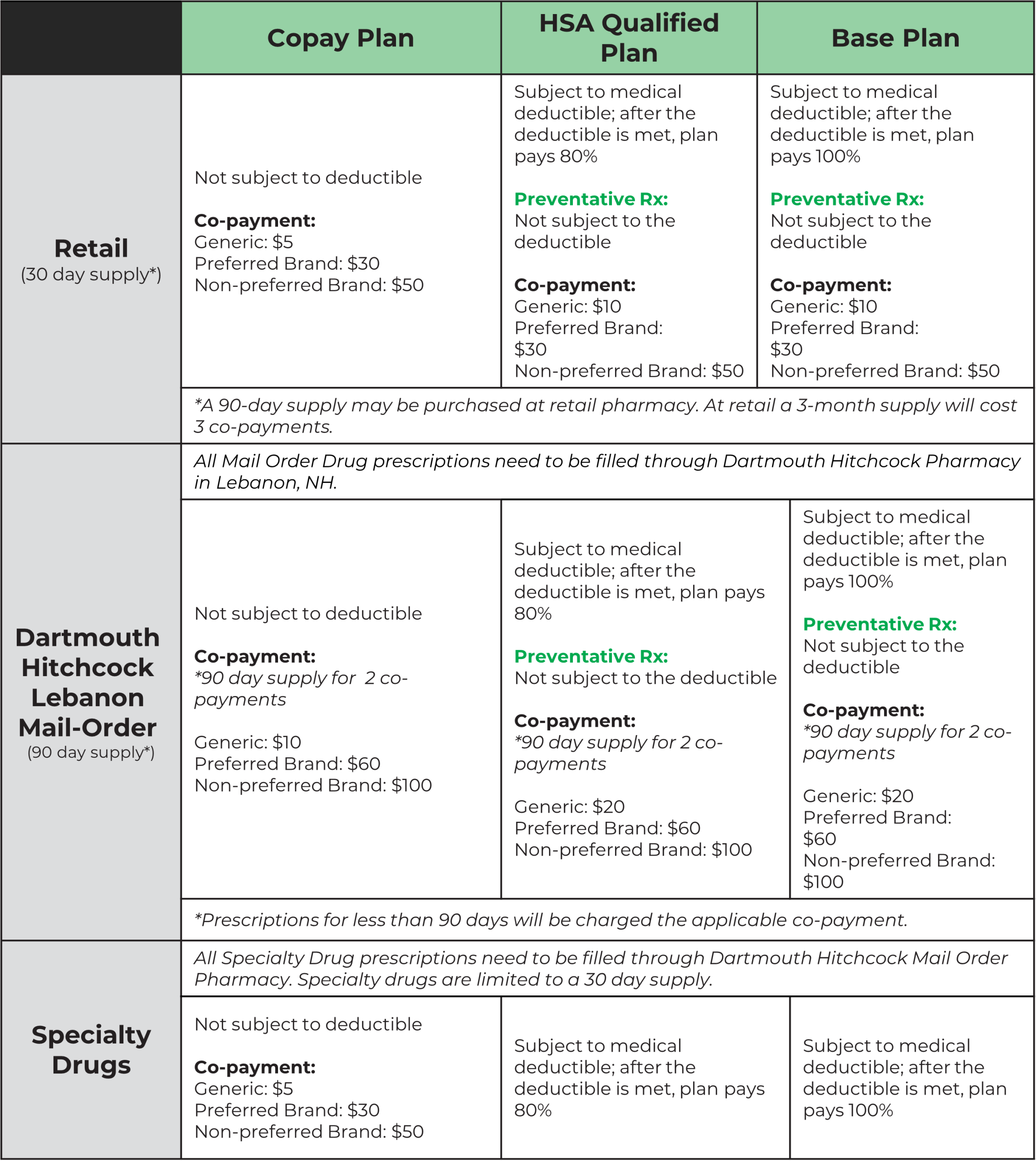

Prescription Drug Plan Overview

Employees must enroll in a Brattleboro Retreat medical plan to participate in the prescription drug coverage. RxBenefits/Optum Rx manages the prescription drug program.

The cost of prescription drugs continues to increase year-after-year, particularly the cost of specialty drugs. Employees may save money by purchasing a 90-day supply of approved – mail order drugs through the Dartmouth Hitchcock Pharmacy, Lebanon. Employees may find additional savings by utilizing CanaRx, an international mail order drug program for brand name prescriptions. Furthermore, employees may find additional savings by utilizing prescription coupons made available at various websites such as GoodRx.com and Walmart.com.

CanaRx Program

CanaRx is an international mail order drug program for brand name prescriptions. Eligible employees and their dependents enrolled in the Copay, HSA Qualified, or Base medical plans have the option of ordering brand name maintenance medications at $0 co-pay through the CanaRx program. This is a voluntary program and does not replace the Brattleboro Retreat’s current prescription benefit plan. Advantages to the plan include $0 copays for all prescriptions offered through the program; no shipping and handling costs; easy enrollment process.

Visit the Brattleboro Retreat’s CanaRx website and covered drug lists by clicking here

- Check to see if your medication is offered by visiting www.canarx.com (WebID: Brattleboro) or by calling 866-893-6337.

- Ask your physician for a prescription for a 3 month supply with 3 refills.

- Before you begin ordering through CanaRx, you must have taken your prescribed medication for at least 30 days.

- Submit a completed enrollment form, prescription, and a copy of your photo identification.

- Medication will be mailed directly to your home. Please allow 4 weeks for delivery.

- Medications are shipped from government-licensed pharmacies in Canada, the United Kingdom, and Australia.

Call 866-893-6337 for more information.

Discount Programs for Weight Loss

If your doctor has spoken to you about weight loss medications, these resources may be helpful.

Important Contact Information

RxBenefits: Pharmacy Program

Customer Service: 800-334-8134

email: RxHelp@rxbenefits.com

Dartmouth Hitchcock: Mail Order Pharmacy

Customer Service: 603-653-3785

Email: dh.pharmacy@hitchcock.org

Dartmouth Hitchcock: Specialty Pharmacy

Customer Service: 603-353-3737

Email: specialty.pharmacy@hitchcock.org

Health Reimbursement Accounts, Health Savings Accounts & Flexible Spending Accounts

Health Savings Accounts (HSA)

A HSA is a tax-advantaged account that allows employees to save pre-tax dollars to pay for qualified medical expenses. The HSA is administered by Health Equity, Inc. For a list of eligible expenses please visit healthequity.com/hsa-qme

To be eligible to enroll in an HSA, you must meet the following requirements:

- Be covered by a high deductible health plan (HDHP) on the first day of the month

- Not be covered by other health coverage that is not an HDHP

- Not be enrolled in Medicare

- Not be eligible to be claimed as a dependent on another person’s tax return

- Not have received VA benefits (Medical or Rx) during the past 3 month

Health Savings Account (HSA)

- Employees are eligible to participate in an HSA if they are enrolled in the HSA Qualified Plan.

- The account is 100% employee funded.

- Employees who wish to contribute to an HSA must activate their account through Health Equity by registering online at healthequity.com

- Employees will also have to name a beneficiary for their account and call Health Equity, Inc at 866-346-5800 to activate their HSA debit card.

- 2026 Contribution Limits:

- Single – $4,400

- Family – $8,750

- Catch-up contribution (age 55+) – $1,000

Flexible Spending Accounts

Flexible Spending Medical Account (FSA)

The Full Purpose Medical FSA is a pre-tax savings account available to employees enrolled in the Copay or Base medical plans or to those who waive medical benefits. The FSA can be used to pay for eligible health care, dental, or vision care expenses that are not covered by insurance for you and your eligible dependents.

- Employees may contribute up to a maximum of $3,400 in 2026 to a health FSA.

- Health Equity administers the Flexible Spending Accounts and after signing up, you will receive a Flex debit card which can be used at the time of purchase for eligible health care expenses.

- A full listing of IRS-approved expenses can be found at healthequity.com/fsa-qme

- This plan includes a rollover provision that allows employees who elect the FSA to roll over up to $680 of unused funds into the next plan year. And if you have funds available, you will be automatically enrolled in the FSA for the next year. (Note: the roll-over does not count towards the IRS maximum allowed in the FSA contribution)

- If you want to contribute in addition to your roll-over, you must make that additional election.

- The deadline for submitting 2026 medical and dependent care claims for reimbursement is March 31, 2027. You may reimburse yourself for expenses incurred between January 1 and December 31, 2026 as long as they were incurred when you were in an active participant in the plan.

Dependent Care FSA (DCA)

The DCA is a pre-tax savings account that may be used to pay for eligible elder and/or child care expenses.

- Employee may contribute up to a maximum of $7,500 (if single or married filing jointly) or $3,750 (if married filing separately).

- In order to qualify for reimbursement, expenses must be incurred for the care of “eligible tax dependents” who the IRS defines as:

- A child under the age of 13, or a child of any age who is physically or mentally incapable of self-care

- Any other tax dependent who is physically or mentally incapable of self-care and who meets specific criteria

Carrier Contact Information

Contributions

HSA: Employee & Employer Funded (Brattleboro Retreat will provide a $10 per pay period match)

FSA & DCA: 100% Employee Funded

Forms and Plan Documents

Health Savings Account (HSA)

Flexible Spending Account (FSA) & Dependent Care Account (DCA)

Additional Information

FSA/HSA Store

The Brattleboro Retreat has entered into a partnership with Health-E Commerce, also known as the FSA/HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your FSA/HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA/HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA/HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA/HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

To access the FSA Store please visit: https://fsastore.com

To access the HSA Store please visit: https://hsastore.com

Additional Information

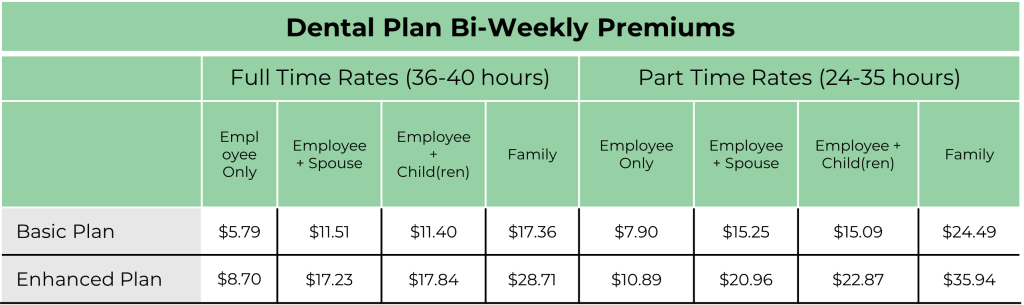

Dental Benefits

Eligibility

All employees who work a minimum of 24 scheduled hours are eligible for coverage on the 1st day of the month following 30 days of eligible service.

Summary of Benefits and Coverages

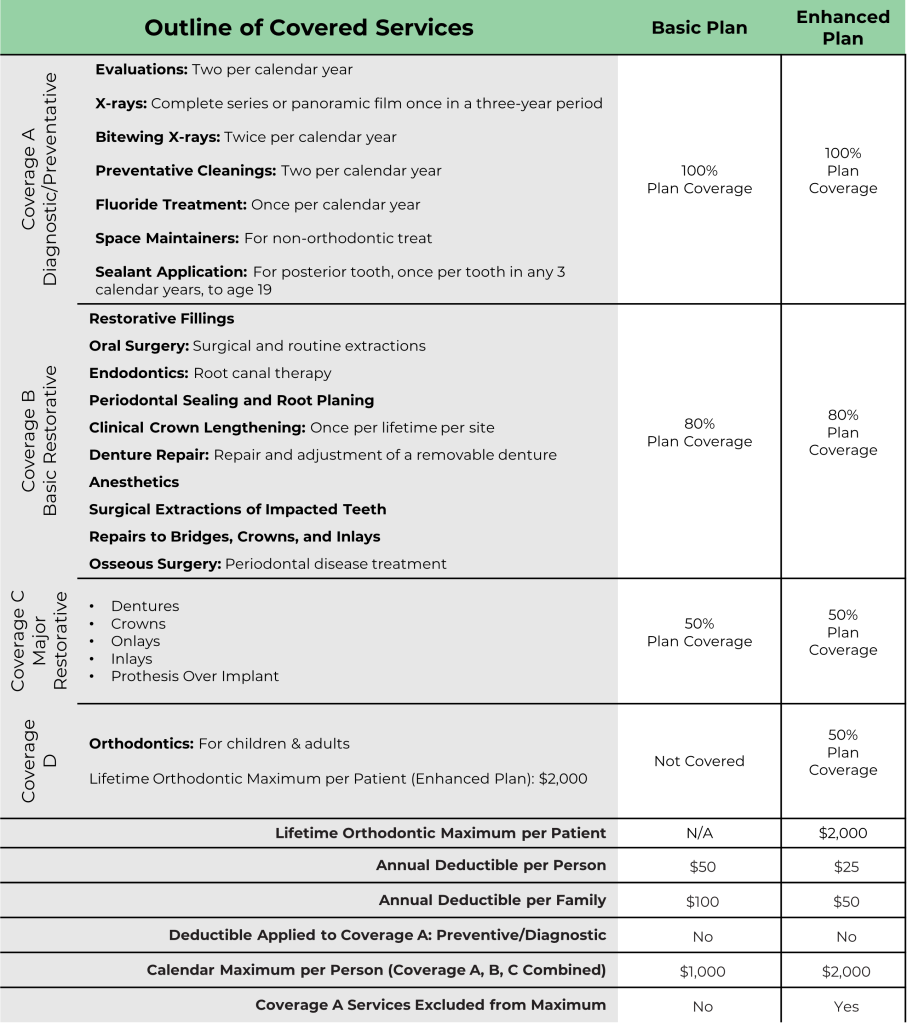

The Brattleboro Retreat offers employees two dental plans options through Northeast Delta Dental.

The chart below provides a high level overview of the dental plan design and features.

Contributions & Rates

Carrier Contact Information

Northeast Delta Dental: Dental Insurance

Customer Service: 800-832-5700

Website: www.nedelta.com

Please click here for the Northeast Delta Dental Provider Directory

(For network, select Delta Dental Premier)

Plan Documents

Helpful Videos from Delta Dental

Vision & Hearing Benefits from Delta Dental

Additional Information

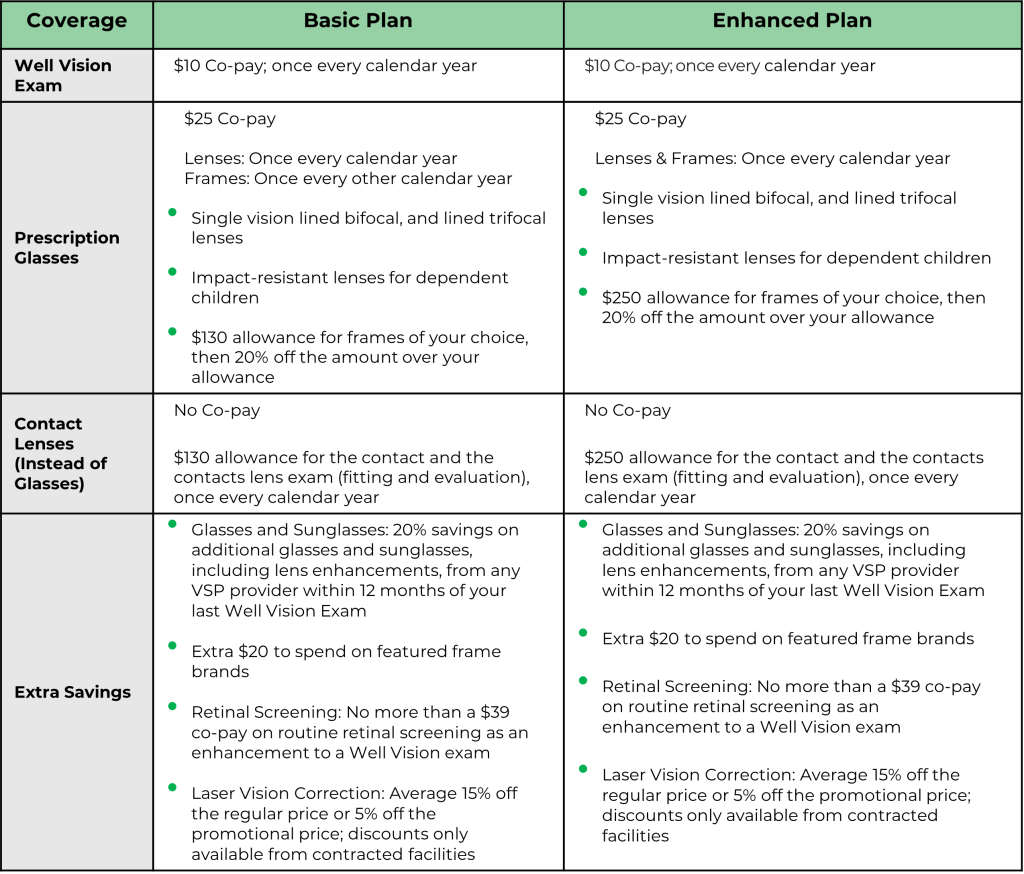

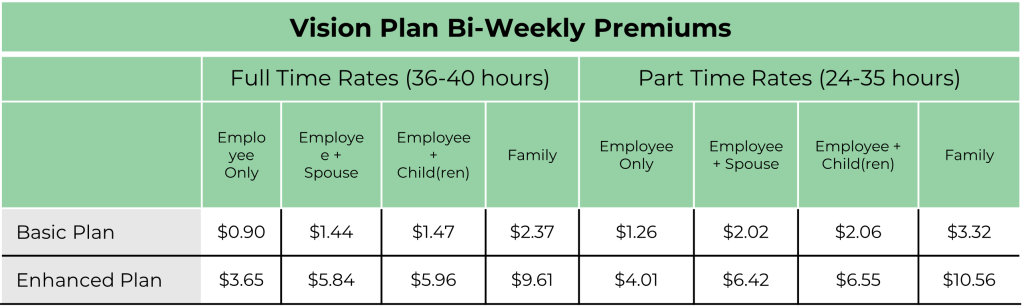

Vision Benefits

Eligibility

All employees who work a minimum of 24 scheduled hours are eligible for coverage on the 1st day of the month following 30 days of eligible service.

Summary of Benefits and Coverages

Brattleboro Retreat and VSP provide you with two affordable vision plans, the Enhanced Plan and the Basic Plan. Get the most of your benefits and greater savings with a VSP network doctor. Your coverage with out-of-network providers will be less or you’ll receive a lower level of benefits. Visit vsp.com for plan details and to search VSP providers.

The chart below provides a high-level overview of the vision plans’ designs and features.

Contributions & Rates

Carrier Contact Information

VSP: Vision Insurance

Customer Service: 800-877-7195

Website: www.vsp.com

Click here for the VSP Provider Directory

Plan Documents

Group & Voluntary Life Benefits

Eligibility

All employees who work a minimum of 24 scheduled hours are eligible for coverage on the first day of the month coincident with or following 60 days of continuous employment.

Summary of Benefits and Coverages

The Brattleboro Retreat provides basic life insurance that covers all benefit-eligible employees following their initial eligibility waiting period with the core benefits of life insurance and accidental death & dismemberment insurance. In addition to these core benefits, employees can supplement their plans by purchasing voluntary life insurance to cover themselves and their families. Please note that if an employee elects Voluntary Life insurance after they are initially eligible, Evidence of Insurability (EOI) will be required and the coverage will have to be approved by the insurance company.

Below is an outline of the coverages available under each plan.

Basic Term Life & AD&D Insurance:

- 100% funded by Brattleboro Retreat

- 1x salary to maximum of $350,000

- Benefits reduce to 65% when you reach age 65 and to 50% when you reach age 70.

Voluntary Employee Term Life & AD&D Insurance:

- Benefit eligible employees may enroll during their new hire eligibility period and during open enrollment each year.

- Employees may elect coverage for themselves in $10,000 increments, to the maximum: the lesser of 7 times their annual salary or $500,000.

- Voluntary Term AD&D coverage may be chosen in the same amounts and are subject to the same maximums.

- Benefits reduce by 65% when you reach age 65 and to 50% when you reach age 70.

- Employees may elect coverage for their spouse in $5,000 increments, up to the amount that they have elected for themselves.

- Employees may elect coverage for their children in $2,000 increments, up to $10,000, for the same cost no matter the number of children they have. Children are covered up to age 19, or up to age 26, as long as they remain full-time students.

- In order to purchase Voluntary Term Life coverage for your spouse and/or child, you must purchase coverage for yourself.

- Employees may increase or add Voluntary Life coverage for themselves by up to $100,000 and up to $20,000 for their spouses without Evidence of Insurability (EOI).

- Guarantee Issue (GI) limits are $150,000 for employees and $30,000 for spouses. Employees can elect up to the GI limits if they apply within 30 days of initial eligibility. A 60-day waiting period of continuous employment applies before initial eligibility.

Carrier Contact Information

![]()

Customer Service: 800-351-7500

Website: www.reliancestandard.com

Contributions

Group Life is 100% paid for by The Brattleboro Retreat.

Voluntary Life is 100% paid for by the employee. Premium costs are based on the amount of coverage approved and the age of the participant.

Forms & Plan Documents

Long-Term & Short-Term Disability

Eligibility

All employees who work a minimum of 24 scheduled hours are eligible for coverage on the first day of the month coincident with or following 4 months of continuous employment.

Summary of Benefits and Coverages

Long-Term Disability Insurance:

- 100% funded by The Brattleboro Retreat.

- Covers benefit eligible employees following their initial eligibility waiting period.

- Benefit is 60% of total monthly earnings to a maximum of $9,000 per month.

- Payment of benefits begin after 90 days from the start of a qualified disability.

Short-Term Disability Insurance:

- 100% funded by The Brattleboro Retreat.

- Covers benefit-eligible employees following their initial eligibility period.

- Benefit begins on the 8th day after the occurrence of a qualified disability.

- Benefit is 60% of total weekly earnings to a maximum of $2,000 per week.

- Partial benefits are based on the percent of lost wages.

Carrier Contact Information

![]()

Customer Service: (800) 351-7500

To File a Claim: https://www.rslclaims.com/ or (855) 775-2524

Website: www.reliancestandard.com

Both LTD and STD Insurance are 100% covered by the Brattleboro Retreat.

Forms & Plan Documents

Accident, Critical Illness & Hospital Indemnity Insurance

Eligibility

All employees who work a minimum of 24 scheduled hours are eligible for coverage during the annual open enrollment period.

Voluntary Accident Insurance:

100% Employee Paid

Accident Insurance is designed to help employees meet the out-of-pocket expenses and extra bills that can follow a covered accidental injury, whether minor or catastrophic. Lump sum benefits are paid directly to the covered employee if they sustain a covered injury. That benefit payment can be used however you’d like to spend it.

Examples of lump sum benefits payable include:

- $400 for ambulance (ground)

- $225 for an emergency room visit

- $75 for an x-ray

Coverage can be elected for an employee, spouse and/or child. Benefits are paid on a tax-free basis; Employee premiums are deducted on a post-tax basis.

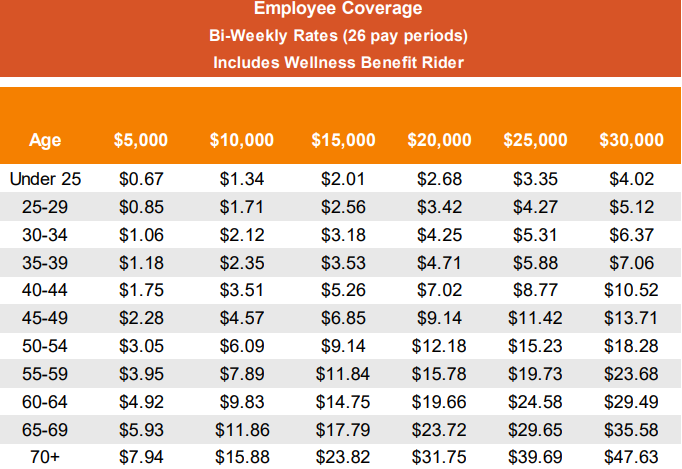

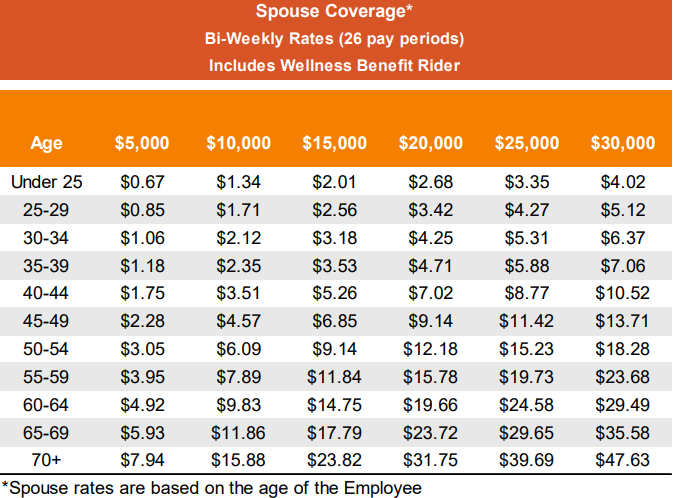

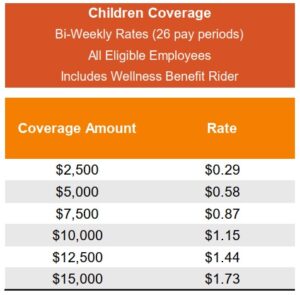

Voluntary Critical Illness Insurance:

100% Employee Paid

Critical Illness Insurance is designed to help employees offset the financial effects of a catastrophic illness with a lump sum benefit if an insured is diagnosed with a covered critical illness. Coverage is available for employees, spouses, and children. Coverage levels can be elected from $5,000 – $30,000 (in $5,000 increments) for employees and spouses. Coverage for a dependent spouse cannot exceed 100% of the employee amount elected. Coverage for children can be elected from $2,500 – $15,000 (in $2,500 increments) and cannot exceed 50% of the employee amount elected.

Benefits are paid on a tax-free basis; Employee premiums are deducted on a post-tax basis. Rates are based on employee’s age at the date of issue. Spouse rates are based on the employee’s age at issue.

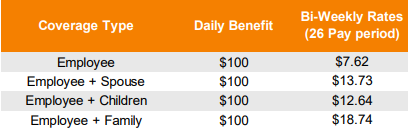

Voluntary Hospital Indemnity Insurance:

100% Employee Paid

With Hospital Indemnity Insurance, you will receive a fixed daily benefit if you have a covered stay in a hospital, that occurs on or after your coverage effective date. Benefits depend on the type of facility and number of days in confinement.

Here is how it works:

- When you are admitted to a covered medical facility, you become eligible for an admission benefit for the first day of confinement with a total benefit amount of $1,000. This benefit is payable once per confinement, up to a maximum of 8 admissions per calendar year.

- Beginning on day two of your confinement, for each day you have a stay in a covered facility, you will be eligible for a fixed daily benefit payment of $100. The benefit amount and maximum number of days per confinement varies by type of facility.

For more information, please review the benefit summaries below.

Additional Plan Documents

Carrier Contact Information

Customer Service: 877-236-7564

Website: https://claimscenter.voya.com/static/claimscenter

Plan Rates

Accident Rates:

Hospital Indemnity Rates:

Employee Critical Illness Rates:

Spouse Critical Illness Rates:

Child Critical Illness Rates:

VOYA Wellness Benefit

Did you know? If you are enrolled in Accident and/or Critical Illness Insurance, you are eligible to receive a $50 wellness benefit to use however you want!

Complete an eligible health screening test and VOYA will send you $50!

- Employees receive an annual benefit of $50

- Spouses receive an annual benefit of $50

- Children receive 100% of your benefit amount per child, with an annual maximum waived for all children.

Please see the flyer below for details on how to file a Wellness Benefit claim

Ask ALEX – Online Benefits Decision Support Tool

Trying to decide which benefits are right for you? ALEX can help. Brattleboro Retreat has partnered with ALEX, a completely confidential online benefits decision support tool that uses your estimated health spending to show you the most affordable plans for your needs.

Before you enroll, take 10 minutes and let ALEX walk you through all of your options. To go to Ask ALEX, click the graphic below.

Please note: You will still need to login to ADP to complete your benefit elections. This online decision support tool is just designed to help you with any questions you may have about your benefit plans.

ALEX will only offer best suggestions based on the answers you provide to the questions it asks. You are not required to choose the plan it suggests if you feel more comfortable selecting a different plan.

Retirement Plan & Financial Wellness

Eligibility

Employees can register and activate a 403(b) account after their first payroll is processed by logging onto Lincoln Financial Group’s website. Employees are eligible for matching employer contributions after one year of employment and must work 1,000 hours of service during the Computation Period (12-month period immediately following date of hire or in any subsequent Plan Year).

Plan Details

Brattleboro Retreat is pleased to offer an employer sponsored 403(b) retirement plan with an employer matching contribution for eligible employees.

- Employees may contribute on a pre-tax or ROTH, after-tax, basis up to the yearly maximum established by the IRS.

- An employee becomes eligible for the employer match after one year of employment (with at least 1,000 hours of service each plan year). The employer match is $0.50 for every dollar the employee defers up to a maximum match of six (6%) percent of gross compensation. To maximize the match, you must contribute 6% to get a 3% match.

- You may contribute $23,500 for the 2025 calendar year. Annual limitations are set by the IRS and are subject to change.

- If you are at least 50 years old, you can make an additional catch-up contribution of $7,500.

- Each year the Brattleboro Retreat may elect to make an employer discretionary contribution to the retirement plan based on an annual review of the hospital’s financial performance.

Financial Wellness

Financial Wellness Resource

Organizing your finances is key to improving your financial well-being. Get started today with Savology, a web-based financial wellness platform that helps you plan and improve your financial future. Start by taking a financial assessment, and receive customized materials made just for you, with resources such as financial literacy courses and planning modules designed to help improve financial outcomes.

Savology is available as a financial wellness and financial literacy resource to all employees.

To Enroll:

To enroll, go to: Savology sign up link

Video Demo & Contact Information

TRG Retirement Plan Consultants

helpretire@therichardsgrp.com

(802)-254-6016

Additional Information about Savology

Retirement Plan Contacts

Plan Documents & Resources

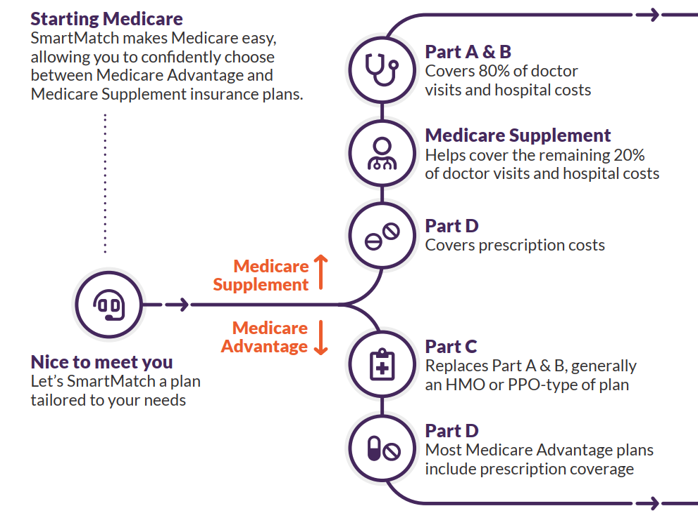

SmartConnect – Medicare Resource

Brattleboro Retreat and The Richards Group have partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether you plan to continue working or are transitioning to retirement, SmartConnect tailors solutions designed around your needs. Agents will provide an unfiltered view of the entire range of options and prices available.

SmartConnect Contact Information

Additional Information

Employee Assistance Program

Eligibility

All employees are immediately eligible to participate in the Employee Assistance Program (EAP) offered by the Brattleboro Retreat.

Program Details

Brattleboro Retreat’s Employee Assistance Program is a free, confidential, and voluntary program for all employees and their adult household members. It is designed to assist you and/or your household members with a wide range of issues in your personal and work lives. Through KGA you have free access to confidential counseling, expert consultations and referrals to resources including child care, elder care, legal, financial, nutrition, career, and daily living.

More information about the program can be found at www.my.kgalifeservices.com (Company Code: Retreat), or by calling 800-648-9557 open 24 hours a day, 7 days a week.

EAP Contact Information

KGA: Employee Assistance Program

Phone#: 800-648-9557

Website: www.my.kgalifeservices.com

Additional Information

Pet Insurance

Program Details

Brattleboro Retreat offers pet insurance through PinPaws (through MetLife). Eligible employees can enroll at any time (not limited to the open enrollment window or new hire eligibility).

Your monthly premium will vary based on details about your dog or cat (such as age and breed) and which plan you choose. You will need to pay with a personal credit card to sign up.

To enroll, visit pinpaws.com/brattlebororetreat.

For more information and to view a list of what PinPaws Pet Insurance covers, visit www.pinpaws.com/pin-paws-pet-care or call 844-746-7297.

How to File a Claim

Take your pet to the vet

Visit any licensed vet, emergency clinic, or specialist in the US. There’s no network of providers to worry about.

Send us your claim

Pay your bill at the vet, then send PinPaws your claim along with vet records and an invoice from the visit.

Get money back quickly

PinPaws will follow up with your vet for any missing info. Most claims are processed in less than 2 weeks.

Pet Insurance Contact Information

PinPaws: Pet Insurance (through MetLife)

Phone#: 844-746-7297

Website: www.pinpaws.com/pin-paws-pet-care

To enroll: pinpaws.com/brattlebororetreat

Additional Information

Professional Development

Continuing Education

Continuing education dollars are available to assist employees in maintaining and upgrading their job-related skills by attending educational programs, seminars, conferences, and related programs.

Brattleboro Retreat encourages employees to be proactive in their own career development by engaging in formal education activities to further develop their current job skills and to prepare them for future career development in the behavioral health field. Eligible employees may request reimbursement for career options that support the overall strategic plan of the organization and which apply to current/future work requirements.

Employees become eligible for prorated funding following three months of benefits-eligible service. Employees must be actively at work, in a benefits-eligible position when the funding is requested and when the reimbursement is due.

The maximum annual benefit is:

- $1,000 after 1 year

- $1,500 after 2 years

- $2,000 after 3 years

The above benefit level is based on a 40 hour schedule. Part-time employees qualify for prorated benefits.

Tuition Reimbursement

The Brattleboro Retreat offers an enhanced tuition program for eligible employees that are interested in pursuing a degree that The Retreat has determined is a critical need for the organization. Please refer to the policy for details or contact the human resources department. This benefit will be available for a limited number of eligible employees. To promote diversity in our workforce, 20% of the openings for this program will be available to minority employees.

529 College Savings Plan

Brattleboro Retreat is pleased to offer a 529 College Savings Plan for employees to be able to save for their child(ren)’s college expenses.

To open a 529 College Savings Plan account, you must complete a College America application available on the Employee Benefits Center website or contact Capital Group American Funds Service Company by calling 800-421-4225 x529.

Additional Benefits Provided By the Brattleboro Retreat

Earned Time Off (ETO)

Brattleboro Retreat provides employees time off with pay for vacation, holidays, personal days, and sick days through the earned time benefit. Accrual is based on actual hours paid up to a maximum of 40 hours per week and on the position and length of service of each employee. For more information, please visit the Earned Time Policy on iConnect under Policies and Procedures.

Wellness Program

Our Wellness Program is designed to promote a healthy lifestyle among employees through various program offerings such as: on-site exercise facilities, health fairs, health screenings, seminars and wellness topics.

Contact Information

Brattleboro Retreat Human Resources

For further information, please reach out to the Brattleboro Retreat Human Resources Team:

Phone: 1 (802) 258-6966

529 College Savings Plan: American Funds

Phone: 800-421-4225

Website: americanfunds.com

Account #: 10457446

GradFin – Student Loan Assistance

The Brattleboro Retreat Student Loan Assistance program is designed to help employees pay back student loan debt and improve their financial well-being. Utilizing Brattleboro Retreat’s relationship with our broker, The Richard’s Group, consultation services provided through GradFin are provided FREE OF CHARGE.

GradFin will:

- Provide one-on-one education with an expert to review your current loan status and discuss payoff options

- Offer a competitive interest rate reduction when you refinance your loans

- Offer the lowest interest rates in the industry through their lending platform

For more information or to schedule a one-on-one consultation, visit:

Home – Gradfin – Achieve your financial goals

Or call 610-639-7840